Long-Term Wealth Development Via Property: A Comprehensive Guide

Property has long been just one of the most reliable courses to lasting wide range production. With the right techniques, investments in residential or commercial property can produce regular capital, tax benefits, and significant recognition with time. Whether you're a seasoned investor or just beginning, recognizing the basics of structure riches via realty is crucial to achieving monetary safety and security.

In this short article, we'll check out exactly how real estate can be a keystone of your wealth-building method, various investment techniques, and workable pointers for success.

Why Property is Suitable for Long-Term Riches Production

Admiration With Time

Real estate values often tend to increase for many years. While markets rise and fall, the lasting trend has actually historically been up, making real estate a solid financial investment.

Easy Income Generation

Rental buildings use a constant income stream, which can expand as rents raise in time.

Utilize Opportunities

Investors can make use of obtained capital to buy property, enhancing potential returns compared to the initial investment.

Tax Advantages

Real estate financial investments feature tax benefits, including depreciation deductions, mortgage rate of interest write-offs, and capital gains tax obligation deferments with approaches like 1031 exchanges.

Portfolio Diversity

Realty offers a hedge versus inflation and lowers dependence on stock market performance.

Approaches for Long-Term Wealth Production in Realty

1. Purchase and Hold Strategy

This involves investing in residential properties and holding them for an extensive duration. Gradually, residential property worths appreciate, and rents boost, optimizing revenues.

Ideal For: Capitalists focused on building equity and easy revenue.

2. Rental Qualities

Having rental residential or commercial properties produces monthly capital while developing equity as tenants pay down the mortgage.

Idea: Invest in high-demand areas to guarantee tenancy rates stay high.

3. Fix-and-Hold

Acquisition underestimated properties, remodel them, and keep them for lasting recognition and rental income.

Perfect For: Investors going to put in preliminary effort for possibly higher returns.

4. Real Estate Investment Company (REITs).

For those who prefer a hands-off technique, REITs use a method to purchase realty without possessing physical property.

Advantage: Supplies liquidity and diversity.

5. Multi-Family Residences.

Purchasing apartment complexes or duplexes can lead to numerous earnings streams from a single property.

Benefit: Higher capital https://sites.google.com/view/real-estate-develop-investment/ contrasted to single-family homes.

Steps to Start Structure Wide Range in Realty.

Establish Clear Goals.

Specify your objectives, whether it's capital, recognition, or both.

Comprehend the Market.

Research neighborhood market patterns, home worths, and rental demand to identify profitable possibilities.

Safe Financing.

Check out alternatives like traditional car loans, FHA financings, or partnerships to money your investment.

Pick the Right Residential Or Commercial Property.

Try https://sites.google.com/view/real-estate-develop-investment/ to find residential or commercial properties with solid possibility for gratitude and rental need.

Concentrate On Cash Flow.

Guarantee the building creates positive cash flow after costs like upkeep, taxes, and mortgage repayments.

Diversify Your Profile.

Buy various property types and locations to reduce danger.

Secret Benefits of Long-Term Realty Investment.

1. Intensifying Returns.

Gradually, reinvesting rental earnings or recognition revenues enables rapid growth in wide range.

2. Equity Structure.

Each home mortgage settlement boosts your ownership stake in the home, increasing net worth.

3. Inflation Hedge.

Real estate worths and rental fees generally increase with inflation, protecting purchasing power.

4. Generational Riches.

Properties can be passed down to successors, producing a legacy of economic safety.

Tips for Successful Long-Term Realty Financial Investment.

Focus on Location.

Invest in areas with solid financial development, great schools, and accessibility to features.

Remain Educated.

Stay up to date with market trends and laws that might impact your investments.

Keep Your Qualities.

Routine maintenance makes sure occupant complete satisfaction and preserves home value.

Deal with Professionals.

Work together with realty representatives, residential property managers, and accountants to enhance your financial investment approach.

Be Patient.

Property wide range creation requires time. Focus on the lasting advantages as opposed to short-term variations.

Top Places genuine Estate Investment.

While chances exist throughout the united state, certain markets are especially for long-term riches production:.

New York City: High demand for rental buildings and prospective for recognition.

Upstate New York City: Budget friendly entry factors and stable development in locations like Albany and Saratoga Springs.

Austin, Texas: Booming tech market driving real estate need.

Phoenix, Arizona: Rapid population growth and budget-friendly residential or commercial properties.

Verdict.

Long-lasting wide range production with realty is attainable with calculated preparation, market expertise, and perseverance. By leveraging the unique benefits of residential or commercial property investment-- gratitude, passive earnings, and tax advantages-- you can develop a diversified portfolio that offers monetary safety and generational riches.

Begin little, inform yourself, and make the most of the many chances realty offers. With the right approach, real estate can be your ticket to a prosperous future.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Tatyana Ali Then & Now!

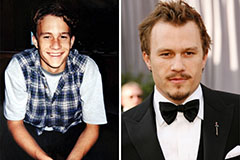

Tatyana Ali Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Batista Then & Now!

Batista Then & Now!